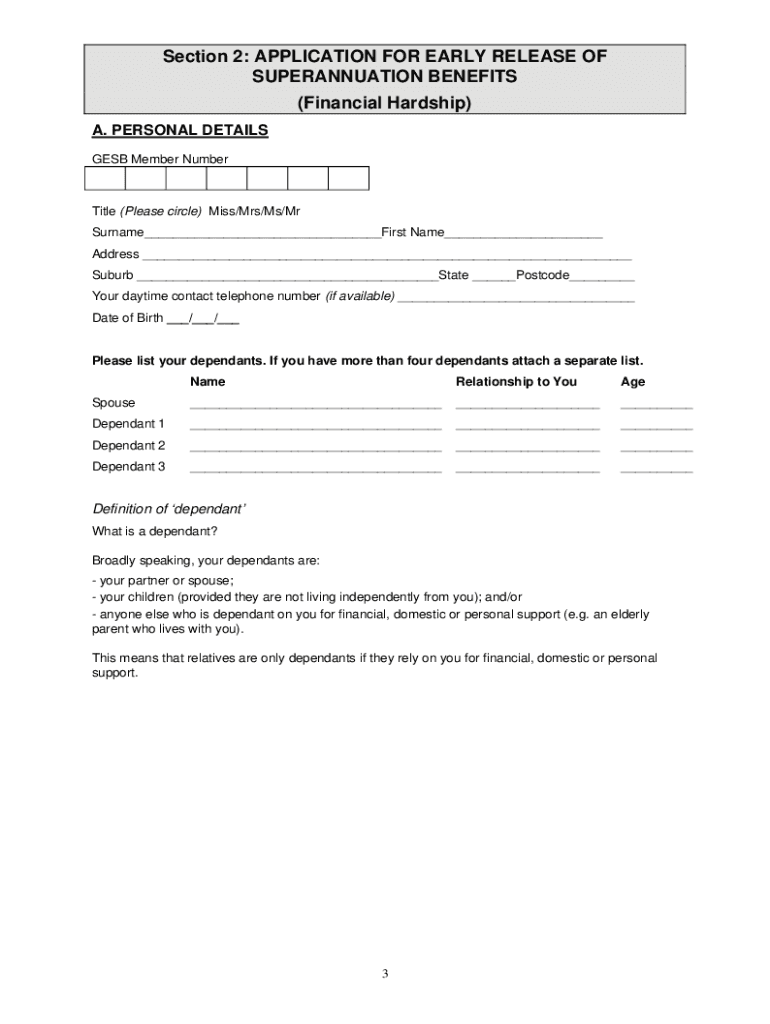

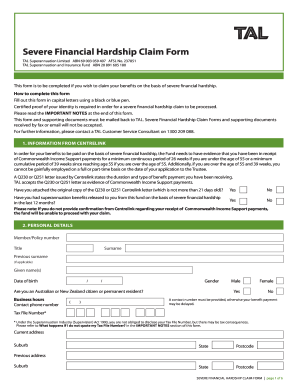

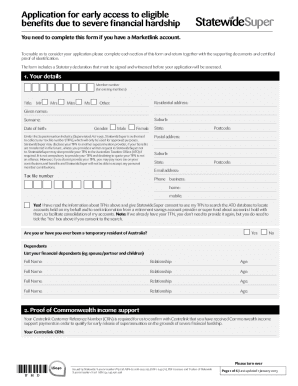

Get the free centrelink q230 form download

Get, Create, Make and Sign

Editing centrelink q230 form download online

Video instructions and help with filling out and completing centrelink q230 form download

Instructions and Help about q230 letter eligibility form

You know everyone purple Z here I hope you're all well in whatever part of the world you're watching this video today is Friday yeah, thank God it's Friday 17th of August 2018 and the time here is 1030 in the morning Australian Eastern Standard Time folks lots happening look I did a've got one sad thing to report, so it's happened this has happened to me again I interviewed David Morgan yesterday as regards to the current financial crises that are happening around the world look it was an hour interviews fantastic interview I couldn't have asked for better, and I pressed the process button this little screen came up that I've never ever seen before and poof video disappeared at the moment I'm hoping that Simon can find it on the weekend and I can actually get it done, but there's no record of it so far in any file I can find how just how that happens I have no idea I'm not a tech guru guy just to say that it's disappointing is you know an understatement it's serious this is actually this time it's really seriously pissed me off to the point where I'm thinking well what's the point you know like surely I can't be that big of a catch in the whole scheme of things you know just this old bloke down in Australia who wants to help wake people up down here, and you know folks I've lost about five computers doing these three phones you know okay you can't make this up folks it's just incredible and like this there's nothing that I'm doing a mind except doing what I'm doing now just making videos, so there's not a lot more I can do, and it's starting to get pretty disheartening to be honest because imagine on David, so he's set himself aside an hour of his valuable time that he could be making money doing, and he's talking to me, and you know trying to get the word out to you and I can't even get the video him you know I can't even process the video it's that bad now, so I'm going to have a good think bad things on the weekend I'm going to try and get my head around the way this has got to work because you know even with Simon's help this is not working these people are you know pretty nefarious honest to be honest I just can't see the point in just going on you know if you understand my position I'm take the time and effort to do it, and it's just every time I do if it's a hassle and now this computer's playing up as well, so there's obviously something going on you can't like you couldn't write this stuff in spy novels you know I mean it's pathetic anyway look MMM no keep the update on that one of the main reasons and looking I'm not going to go on about this for a long time, but I'm hoping that you all speak to other restrains and shown this video because what I'm about to tell you and say or saying tell you are very, very important I've always said and remember this is not financial advice I'm an economic hack, so I'm just giving you my economic view of things I've always said that the upcoming there will be a financial crash, and you know all the...

Fill centrelink q230 form pdf : Try Risk Free

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your centrelink q230 form download online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.